Effectively Using Decision Support Solutions (Part I of III): Psychological Foundation

In the study of economics, understanding individual incentives is critical to understanding motivation, decision making, and economic outcomes. At the decision point, understanding one’s “locus of control” and related psychology is the key to unlocking an individual’s rational mindset. Decision support solutions can be a big help to bring together people with differing psychology, differing professional judgments and for the purpose of driving optimal and efficient decisions.

This is Part I of a three-part series.

(Please click the boxes for the other article sections.)

Decision-Making Economics and Psychology Background

There is much to unpack here, so we will start with rationality, then move to locus of control. We will help to bring the ideas together with a train thought experiment. We will conclude by discussing group decision making leadership approaches, methodologies, and solutions.

There was a time when economists thought of rationality as a collective fixed point. Economists would determine a single “economic rational” decision for a particular question. That single economic rationality was then assumed to be the long-term equilibrium for all the economic participants. Any deviation from that economic rationality was considered a short-term aberration, but inevitably on its way to the long term economically rational equilibrium.

Paul Samuelson, John Muth, Robert Lucas, and others used fixed economic rationality as an underlying assumption to build mathematical-based models and theories. (1) Ultimately, many of those theories have lost some of their explanatory power. (Or, perhaps, those theories did not have much explanatory power in the first place.) Behavioral economists such as Daniel Kahneman, Amos Tversky, Richard Thaler and others consider economic rationality as relative. That is, rationality is relative to the individual, behaviorally based, and varies across a multimodal distribution. (2) Across a large number of people, fixed economic rationality is only a boundary condition. Thus, aggregating individual rational preferences is very tricky. As such, “rationality” is user defined and very sensitive to local conditions at the time the decision is made. If you have ever asked someone “Why did you do that?” a common answer is often,

“Well, it seemed like a good idea at the time.”

This is exemplar rationality in the real world.

Since rationality is relative, psychological concepts like “Locus of Control” is critical to understanding one’s rational mindset at the time an economic decision is made. First, let’s start with a definition (3):

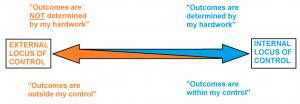

Locus of control is the degree to which people believe that they, as opposed to external forces (beyond their influence), have control over the outcome of events in their lives. A person’s “locus” is conceptualized as:

- Internal – a belief that one can control one’s own life or

- External – a belief that life is controlled by outside factors which the person cannot influence, or that chance or fate controls their lives

People may perceive varying loci of control along a continuum. Individuals and cultures may have different propensities for locus of control. For example, the American individualistic culture will skew more toward the internal locus of control. But situations certainly impact one’s locus of control mindset at the time a decision is made. Different levels of uncertainty between situations may cause an individual to have situationally dependent loci of control.

Also, individuals tend to assign locus of control based on decision outcomes. In identical situations, it is natural to associate:

- Positive outcomes with an Internal Locus of Control. (i.e., “My hard work caused this positive outcome”), or

- Negative outcomes with an External Locus of Control. (i.e., “The actions of others caused this negative outcome”)

Naturally, if the situation is identical, you cannot have it both ways. The actual situation outcome must exist at a single point on the causality spectrum. Thus, there is a gap between actual control and one’s psychology-based locus of control. The gap or variability from actual is also known as noise. (4)

Noise may be driven by:

- Cultural norms;

- People, related to uncertainty or education level;

- The same person in different situations; or

- The same person in the same situation but in different conditions.

As part of my American cultural programming, I tend to initiate myself on the “I am in control of my fate” end of the spectrum. Only after deeply learning about a system’s dynamics, does my reality shift to the “I have less control than I thought” end of the spectrum. I must admit, the optimism and determination associated with “I am in control of my own fate” is very helpful. It is almost like I start by fooling myself, but I believe that optimism and determination does sustain me to do better work. If I was initially more realistic, maybe I would not have done as well, even though I had less control than I thought. It is quite a paradox!

Also, understanding one’s impact on an organizational system at the system’s level does help one understand the system’s dynamics, their place in the system, and helps one understand how to get the most out of the system, even if one has less control than they originally thought over the system.

Please follow the link at the top of the article for additional sections.

For more information, please contact Definitive Business Solutions, Inc.:

- John Sammarco, President | JSammarco@DefinitiveInc.com

- Jeff Hulett, Executive Vice President | JHulett@DefinitiveInc.com

Notes:

- John Muth (1961) Rational Expectations Theory. The theory was more extensively utilized in macroeconomics by Robert Lucas.

- Daniel Kahneman and Amos Tversky (1979). Prospect Theory: An Analysis of Decision Under Risk. The theory demonstrates how people are asymmetric in how they react to loss aversion. It also shows how psychological anchoring can impact this reaction. Daniel Kahneman earned a Nobel Prize as a result of this theory and work related to the integration of psychology and economics.

- Julian B Rotter (1966). Generalized expectancies for internal versus external control of reinforcement

- Daniel Kahneman, Cass Sunstein, and Olivier Sibony (2021) Noise: A Flaw in Human Judgment. The 4 listed gap types are related to noise archetypes described in Noise. They are Level Noise, Stable Pattern Noise, and Occasion Noise. When comparing bias and noise, the authors make a powerful case that noise is far more impactful and difficult to manage in the decision-making process. A more fulsome explanation is provided in: Jeffrey Hulett (2021) Good decision-making and financial services: The surprising impact of bias and noise.

- Richard Thaler and Cass Sunstein (2008) Nudge: Improving Decisions About Health, Wealth, and Happiness

- Thomas L. Saaty (1982) Decision Making for Leaders: The Analytic Hierarchy Process for Decisions in a Complex World

- Definitive Business Solutions, Inc. designed and integrated a bespoke solver engine, utilizing a number of solver programing code sets and data transmission capabilities, uniquely needed for the AHP and cloud environment.

© 2021 Definitive Business Solutions. All Rights Reserved.