Effectively Using Decision Support Solutions (Part III of III): Decision Support Solution

This is the third part of our series; we will address the more practical aspects of successfully implementing Decision Support Solutions. As part of the success platform, we will make use of the psychological and economic concepts presented earlier. Decision support solutions can be a big help to bring people together with differing psychology, incentives, professional judgments and for the purpose of driving optimal and objective decisions.

This is Part III of a three-part series.

(Please click the boxes for the other article sections.)

Leadership and Decision Approach

Group decision-making participant dynamics are often messy. They may include many tensions or concerns, such as:

- The “loudest voice” may get undue decision weight.

- Hidden agendas may create decision noise.

- There are many hidden costs in assembling objective information to manage the decision process.

- “Monday morning quarterback” questioning from “overlords” (auditors, regulators, plaintiff attorneys) make decision record keeping critical

- It is challenging to aggregate multi-criteria, multi-alternative, business case-informed decision recommendations.

- The decision structure is important to diffuse emotions or other concerns about the credibility of the decision process.

For group decision-making, group leaders must understand the nuances (like psychology, incentives, etc.) of the team participants. Also, creating a sense of decision outcome ownership is important. Team members need to have clear roles AND have the sense they will have a positive impact on the organizational system.

Also, good decision making comes from engaging all the team members. The leader’s job is to create a success environment, including a:

- Decision environment where the team members have a sense of ownership based on their involvement in the decision process.

- Decision process that seeks to utilize the unique judgement of the team members and associated objective information to make decisions.

- Decision memory that records decisions, the individual inputs to those decisions, and the degree of variability of the decision inputs. (Recall the “multimodal distribution” from Part 1).

An effective decision-making approach will ultimately reduce noise and optimize the quality of the decision.

Leadership and Decision Support Solutions

At this point in the article series, we have presented the dynamic character and challenges in making high quality economic decisions. We appreciate group decision making risks include noisy and suboptimal outcomes, owing to our naturally occurring but often hidden psychological influences. Next, we will present a technology-enabled, noise reducing decision support solution and methodology. For this solution discussion, we are primarily focused on a wide variety of strategic or portfolio-based investment decisions. This decision category is generally focused on companies that make decisions about how to deploy capital or related investments. This decision category is characterized by:

- A fixed or finite amount of investment resources or capital to invest in projects.

- Several potential projects at various stages in their maturity cycle. That is, some potential projects maybe well known in terms of cost, benefit, risks, and impact to current state. Other potential projects may need further clarity.

- A relatively large group of stakeholders with various motivations and roles. This includes people that: a) provide decision judgmental input, b) provide decision objective input, c) will implement the project, d) have an invested interest in the success of the projects, or e) some or all the above.

Financial Services companies often utilize strategic or portfolio-based investment decisions for:

- Product portfolio decisions

- Technology portfolio decisions

- Simulation-based credit forecasting decisions

- Third-party supplier portfolio decisions

- Merger and Acquisition decisions

- Strategic investment portfolio decisions

- Branch network portfolio decisions (new / consolidations / closures)

- Marketing sponsorship portfolio decisions

- and many others

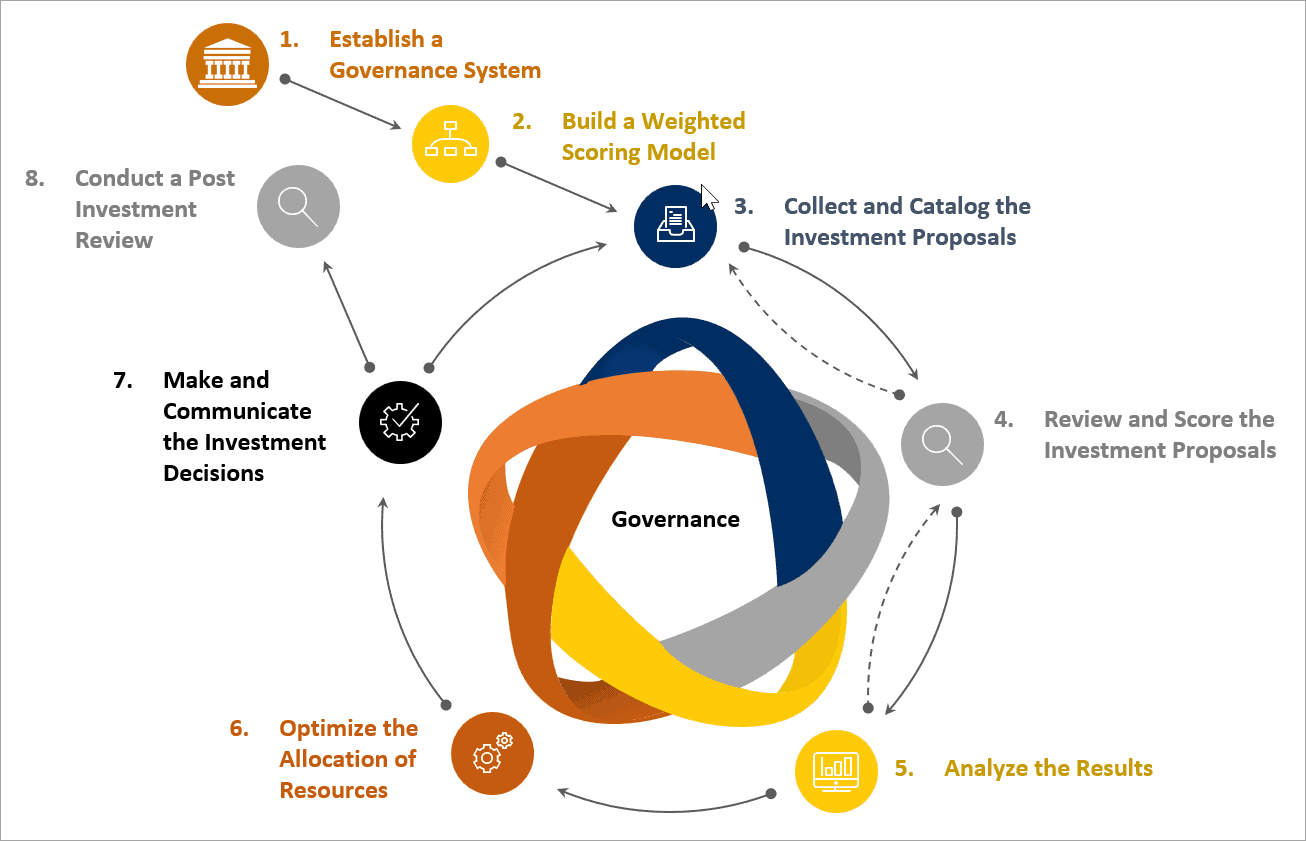

The Decision Support Solution Methodology

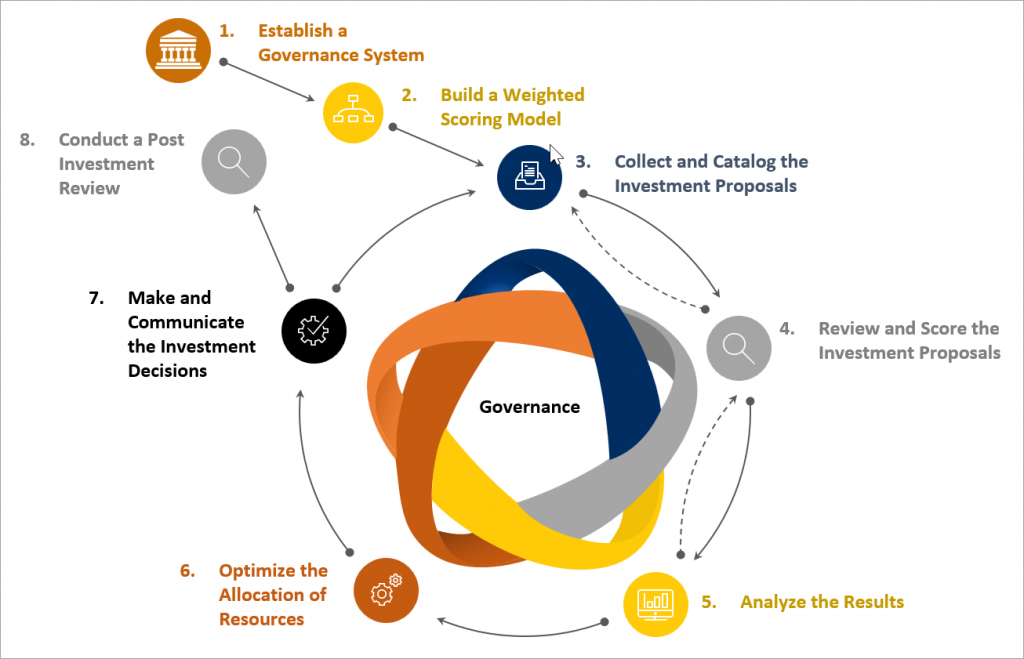

Successful strategic investment selections are characterized as a team sport. Earlier, we discussed tensions that may create challenges. As such, the methodology must be collaborative, promote teamwork, and build consensus. It uses eight steps, as shown in the next graphic. Steps 1 and 2 are foundational. Once they are completed, the governance system and weighted scoring model(s) should be reassessed for continuous improvement on a periodic basis (perhaps annually or semi-annually). These foundational steps set the stage for the operational cycle of steps 3 through 8, which continue in an evolutionary fashion.

Step 1 – Establish a Governance System

The first order of business is to set up a governance system. This may take the form of a single investment review board (IRB), or in the case of large organizations, a multi-tier set of IRBs. For example, department-level board decisions may feed into business unit-level boards, and business unit board decisions may feed into an enterprise-level board.

Step 2 – Implement a Weighted Decision Model

Decision models are designed to help decision-makers comprehensively and consistently assess the strategic value of competing investments. For strategic investment selection, scoring models consist of a strategic goal, strategic objectives, measures (optional), and associated rating scales. Establishing the relative importance of the strategic objectives is crucial to building an effective scoring model. The weighting factors must be accurate and enjoy the consensus of the group. The Analytic Hierarchy Process (AHP) is the gold standard for performing this critical step. (6)

Step 3 – Collect and Catalog the Investment Proposals

Keeping in mind that the best ideas often come from those are closest to the “problem”, and that the diversity of proposals will be directly correlated to the diversity of those who are able to participate, the opportunity to prepare and submit an investment proposal is extended to the largest number of stakeholders that is practical for the organization.

Step 4 – Review and Score the Investment Proposals

To build the most consensus in the investment decisions, all investment proposals are evaluated against all the strategic objectives. When investment proposals are partially evaluated or rejected without an evaluation by the IRB, the degree to which the team will embrace the investment decisions is negatively impacted.

Step 5 – Analyze the Results

The facilitator-led investment scoring sessions generate a significant amount of data to analyze, requiring the generation of several charts and tables to support the analysis and facilitate the IRB’s review and decision. The analysis covers strategic business value, costs, and risks. The analysis approach enables the separation and clarification of objectives, facts, and the judgments of the team members.

Step 6 – Optimize the Allocation of Resources

Using a mathematical programming solver for optimization (i.e., an optimizer), the IRB will extend their decision-making capabilities beyond prioritization. Optimizers are in the most advanced category of data analytics tools, which is prescriptive analytics. They help answer the question: “What should we do?” They are particularly useful when making strategic investment selections because when multiple investments are being made, the purpose of the decision is not to select the most preferred investment, but rather to select the most preferred combination of investments that deliver the maximum benefit to the strategic goal (i.e., “bang for the buck”).

Step 7 – Make and Communicate the Investment Decisions

Prior to making investment decisions, a sensitivity analysis is conducted to determine the degree to which the recommendations are sensitive to slight variations in the weighting of the strategic objectives. The sensitivity analysis will increase the IRB’s confidence in their decisions.

One of the IRB’s roles is to maintain the credibility of the decision process. An important accountability is to confirm business case outcomes over time. In step 3, individual stakeholders provide a business case investment proposal. Those investment proposals are vetted for reasonableness at the time. The post investment review validates the realization of investment proposal value over time and provides valuable learnings for inevitable course corrections.

Step 8 – Post Investment Review

The first order of business is to set up a governance system. The industry standard is to establish an investment review board (or “IRB”). The “secret sauce” of the IRB is to walk the line between structure and agility. The structure needs to be sufficient to oversee the process, encourage participation, develop a charter and procedures, and manage timelines. The IRB needs to be nimble. It should encourage a rapid integration of business information and the completion of the decision model. A sound and technology-enabled structure enables speed to complete.

The Key Benefits

This strategic investment decision-making methodology consistently delivers the following benefits:

- Process consistency and transparency

- Improved stakeholder engagement

- Increased cross-functional insight

- Greater consensus and buy-in

- Optimized allocation of resources

- Higher velocity decisions

- Better return on investment

- Strategically aligned investments

- Justifiable decision rationale

- Historical record of decisions

This decision support solution methodology was created by Definitive Business Solutions, Inc., and is enabled by Definitive Pro®, a cloud-based, group decision support service that provides a collaborative process to build consensus and make complex, multi-criteria decisions in a wide range of scenarios. It uses the leading theory in multi-criterion decision making (the Analytic Hierarchy Process), which provides the ability to synthesize quantitative and qualitative factors and set priorities. It also employs a state-of-the-art mathematical programming solver to find the most favorable solution and optimize the allocation of resources. (7)

Please follow the link at the top of the article for additional sections.

For more information, please contact Definitive Business Solutions, Inc.:

- John Sammarco, President | JSammarco@DefinitiveInc.com

- Jeff Hulett, Executive Vice President | JHulett@DefinitiveInc.com

- John Muth (1961) Rational Expectations Theory. The theory was more extensively utilized in macroeconomics by Robert Lucas.

- Daniel Kahneman and Amos Tversky (1979). Prospect Theory: An Analysis of Decision Under Risk. The theory demonstrates how people are asymmetric in how they react to loss aversion. It also shows how psychological anchoring can impact this reaction. Daniel Kahneman earned a Nobel Prize as a result of this theory and work related to the integration of psychology and economics.

- Julian B Rotter (1966). Generalized expectancies for internal versus external control of reinforcement

- Daniel Kahneman, Cass Sunstein, and Olivier Sibony (2021) Noise: A Flaw in Human Judgment. The 4 listed gap types are related to noise archetypes described in Noise. They are Level Noise, Stable Pattern Noise, and Occasion Noise. When comparing bias and noise, the authors make a powerful case that noise is far more impactful and difficult to manage in the decision-making process. A more fulsome explanation is provided in: Jeffrey Hulett (2021) Good decision-making and financial services: The surprising impact of bias and noise.

- Richard Thaler and Cass Sunstein (2008) Nudge: Improving Decisions About Health, Wealth, and Happiness

- Thomas L. Saaty (1982) Decision Making for Leaders: The Analytic Hierarchy Process for Decisions in a Complex World

- Definitive Business Solutions, Inc. designed and integrated a bespoke solver engine, utilizing a number of solver programing code sets and data transmission capabilities, uniquely needed for the AHP and cloud environment.

© 2021 Definitive Business Solutions. All Rights Reserved.